Piper's Landing Country Club Hosts April Palm City Monthly Breakfast

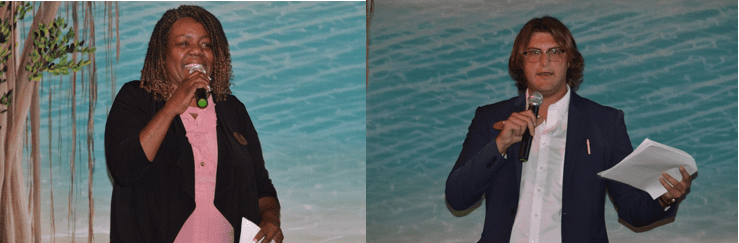

In Photo: Speakers for the breakfast - Kowalski, Tuttle, McKee & Associates with Merrill Lynch

Article & Photos by: Robin Hall - Out2News.com

On Wednesday, April 24, 2024 the Palm City Chamber of Commerce had their monthly breakfast at Piper's Landing Golf & Country Club. Breakfast was delicious as always and the staff was very attentive!

Piper's Landing Golf & Country Club is a "Resident Member Only" golf community conveniently located on the Treasure Coast of Florida. Embrace Florida as it is meant to be – Piper's is known for its elegant yet unpretentious lifestyle. Enjoy your golf game against the stunning landscape of a private, championship golf course. Set sail from the calm waters of our naturally protected yacht basin or challenge your hand on our Har-tru tennis courts and Pickleball courts. They are located at: 6160 SW Thistle Terrace in Palm City.

Call them for more information at: 772.283.7000 or email: info@piperslanding.com

The monthly breakfast featured presentations by Steve Kowalski Financial Planner with Merrill Lynch and Anna Valencia-Tillery from White Glove Moving & Storage.

Mr. Kowalski with Merrill Lynch Wealth Management Branch in Stuart spoke about working with individuals, families, business owners, executives and institutions. They are committed advisors which call upon Merrill’s tools and resources to help clients pursue personal and professional financial goals, as they also help them prepare for financial and lifestyle challenges that may lie ahead. For more information contact them at: 772.223.6760.

Anna Valencia-Tillery with White Glove Moving & Storage always has an interesting way of telling the membership what this company does.Their mission is “Delighting our Customers by Exceeding their expectations" is in the forefront of what they do daily. They provide Treasure Coast Moving and Storage solutions people can count on. Call them at: 772-778-4750 for more information.

The mission of the Palm City Chamber of Commerce is to serve as the principal advocate of the community and its businesses, acting as the catalyst in promoting the economic development of the Palm City area, stimulating jobs and improving the quality of life. Located at: 2701 SW Cornell Avenue in Palm City. For more information about the chamber call them at: 772-286-8121.

Out2News.com LLC. is your Treasure Coast online newspaper, “Who they are, what they do and where they do it”?

Do you have something to say, an event to talk about? An event you would like to have covered. Do it here!

Email your story or request to: rshall@out2news.com

Out2News adheres to full compliance with C.O.P.P.A. (Children’s Online Privacy Protection Act of 1998)

In Photo: Speaker for the breakfast Anna Tillery with White Glove Moving, Storage & Delivery

In Photo: Cher Fisher - Family Promise, Chris - Twinkles Jewelry & Gifts and Celeste with Personal Training by Celeste

In Photo: Mike Gonzales with Blue Stream Fiber and Carolyn Leibowitz with Cruiseplanners

Hobe Sound Chamber of Commerce April Breakfast Hosted by Harry & The Natives Bar & Grill

In Photo: Harry MacArthur always with a smile serving his customers

Photos & Article by: Robin Hall - Out2News.com

Hobe Sound - On April 11, 2024 the Hobe Sound Chamber of Commerce a held their monthly breakfast at Harry & the Natives Bar & Grill. With down-home cooking and eclectic Old Florida atmosphere, it always a pleasure to attend any meal at this awesome restaurant. Harry MacArthur always is warm and welcoming when it comes to events. He never disappoints. Harry and the Natives opened their doors in 1941. They are located 11910 SE Federal Highway in Hobe Sound.

The breakfast was sponsored by Absolute Care Nursing Services Inc. who specialize in helping Seniors in the Treasure Coast of Florida receive quality home health care. They provide clients across the surrounding counties with flexible schedules and services to fit their specific needs. A home care referral company which serves residents across Florida’s Treasure Coast, including Jupiter, Hobe Sound, Stuart, Jensen Beach, Port St. Lucie, Palm City, Vero Beach, and Ft. Pierce. No matter what your particular needs may be, they will match you with a qualified and vetted caregiver who will be there to provide compassionate and reliable care. Their goal is to help you live a better life by helping you remain in the comfort of your own home for as long as possible. They are located at 850 NW Federal Highway, Suite 204 in Stuart. Call them at:(772-837-6542 for more information.

Today the membership played a networking Bingo game to get to know each other and tell each other what their business was all about. Something different to do on a beautiful Florida morning!

The Hobe Sound Chamber of Commerce plays a significant role in the Martin County and northern Palm Beach County business community. The Chamber is a business organization financed entirely by membership investments. It provides opportunities for members to stay connected, network, advertise, receive continuing education, business support and always gives back to their community. They are located at: 8958 SE Bridge Rd, Hobe Sound. Contact them at: 772-546-4724

Out2News.com is your local Treasure Coast online newspaper where you are the reporter, photographer and YOU report the news! Do you have something to say, an event to a talk about? An event you would like us to have covered.

Photo by: Courtesy of Robin Hall - Out2News.com

Out2News.com adheres to full compliance with C.O.P.P.A. (Children's Online Privacy Protection Act of 1998)

"Your Treasure Coast Newspaper & Photo Journal"

Copyright © 2024 Out2News.com LLC. All Rights Reserved.

In Photo: William "Jay" Connelly with Connelly Law - New President Hobe Sound Chamber of Commerce

In Photo: Absolute Care Nursing Services

In Photo: Jennifer Russell - District 3 Hobe Sound, Brandon Woodward, Tera Krueger - C&W Computers

Impact100 Martin Announces 7 Finalists for 2024 Impact Grants

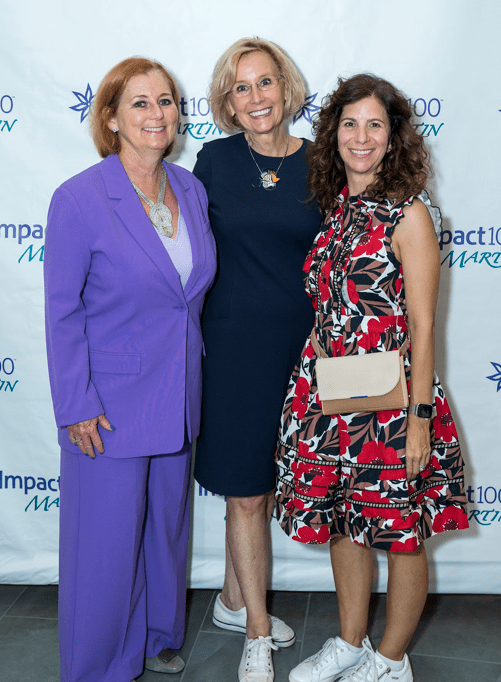

In Photo: Wendy Steele (Center)founder of the Impact 100 and Impact100 members Sue Whittington and Tiann Berhoff

Stuart - Seven finalists have been chosen for this year’s Impact100 Martin 2024 Impact Grants, with four $100,000 grants to be awarded at the annual awards ceremony on April 18 at Temple Beit HaYam in Stuart.

Each of the seven nonprofit organizations is proposing an innovative project that meets community needs. Impact100 Martin’s 422 members have an opportunity to review the proposals in advance and hear presentations in person on the 18th. Each member casts a vote for the 4 projects that she believes best meet the criteria for impact, effectiveness and sustainability.

“We’re especially excited this year,” said Impact100 Martin’s President Maureen Cotter, “because of the quality of the proposed projects and also because we can award four grants in one year for the first time in our history. We met and then exceeded our membership goals for 2024. With 422 members, we have the funds to give out four $100,000 awards and distribute another $22,000 to the other finalists.”

The finalists are: The ARC of the Treasure Coast with Caring Café: Food from the Heart; Council on Aging of Martin County with Elder Care Mobile Outreach Program; Historical Society of Martin County with The Martin Encounter – A Multi-sensory Mural and Living History Exhibit at the Elliott Museum; Ocean Research & Conservation Association with One Health Fish Monitoring Citizen Science Program; Senior Resource Association with Same-Day Transportation Service; Treasure Coast Wildlife Hospital with Wildlife Rehabilitation & Education Animal Enclosures; and Tykes & Teens with Walk In Assessment Center.

The Impact100 model is a unique and effective way to leverage women’s philanthropy, according to Cotter. Each woman contributes $1,000. Each member then has a vote to choose outstanding projects in the fields of Arts & Culture; Education; Family; Health & Wellness; and Environment, Preservation & Recreation. Each grant is for $100,000, an amount sufficient to make a real impact in the community.

Now in its seventh year, Impact100 Martin has awarded a total of $1.8 million in grants to local nonprofits since 2017. All of the projects that received awards in past years are described on the Impact100 Martin website, www.impact100martin.org.

Only members can vote, but the public is invited to attend the awards ceremony and listen to the grant finalists. Registration and more information are available at www.impact100martin.org.

Education Foundation of Martin County Plans Evening of Excellence

In Photo: Linda Fitzpatrick, Lindsey Albertson, Cynthia Pilloni, Karina Talalay

Photos by: Doreen Porebo

Palm City — “Beauty and the Beast” is the theme of this year’s Evening of Excellence | Bids for Kids event, which benefits Martin County students. Hosted by the Education Foundation of Martin County and presented by Morganti, this elegant gala fundraiser will take place on Saturday, April 20, at Harbour Ridge Country Club in Palm City and is expected to be a sell-out.

Tickets are $250 per person (must be 21 and older to attend) and there are a limited number for sale. The event raises funds to assist the Education Foundation with enriching and enhancing the quality of education in Martin County’s public schools.

This year's “Beauty and the Beast” theme was specially selected by Rob Gluckman, CEO of lead sponsor Treasure Coast Urgent Care.

“The story is centered around Belle, a character who loves books, is an avid reader, inspires others to read and serves as a good role model to our students,” said Gluckman. “Belle also learns that it's what's on the inside that counts, not outer appearances, another valuable lesson for children.”

The evening will kick off in style with cocktails and a variety of hors d’oeuvres. Guests will make their way into the clubhouse as they step onto a Beauty and the Beast themed carpet. Then they’ll go through a giant rose arch entrance to the custom Cogsworth ice luge that features the evening's signature cocktail.

During the cocktail reception, sponsored by Hedrick Brothers Construction, guests will have the opportunity to participate in the silent portion of the Education Foundation’s hallmark Bids for Kids auction. Hundreds of items are expected to get their attention, especially knowing the proceeds are going to a worthy cause. The silent auction items include fishing charters, gift baskets, vacation getaways, spa treatments, golf packages, jewelry and artwork.

Before the dancing begins, volunteer auctioneer Tom Melander will elevate the bidding during the live portion of Bids for Kids as guests feast on Enchanted Rose Garden Salad and Chateau de Beef Tenderloin & Maritime Stuffed Shrimp or a vegetarian option.

Stephen Sines, vice president of operations for Morganti, longtime presenting sponsor, stated, “Morganti is proud to once again support the Foundation’s mission of enriching and enhancing educational opportunities and support for students and teachers in our community.”

Keiser University, Jeanine Webster & Mel Nobel, Gehring Group, UDT, Proctor Construction, PNC and others are also generously sponsoring the event.

For information, to buy tickets, or learn about sponsorship opportunities, visit www.EducationFoundationMC.org.

In Photo: Robert Gluckman, Esq., Michael Maine, Jennifer Russell, Lindsey Albertson, Brent Martin

Helping People Succeed Receives Accreditation from CARF

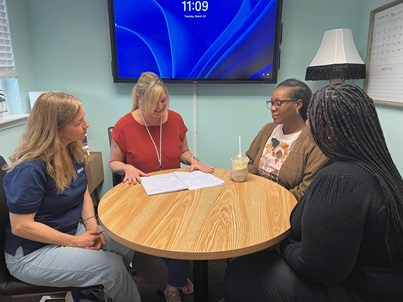

In Photo: Laura Leveille, Kim Cittadino, Brandi Ikner, Samantha Nesbitt

Photo by: Helping People Succeed / Article by: Jackie Holfelder

In 1966, the Commission on Accreditation of Rehabilitation Facilities was founded. It is now known as CARF International.

The job of this accrediting body is to establish consumer-focused standards that help organizations measure and improve the quality of their programs and services.

Recently, Helping People Succeed was issued a three-year accreditation by CARF for four of the programs it provides to the community. They are:

Case Management/Services Coordination: Mental Health (Adults)

Case Management/Services Coordination: Mental Health (Children and Adolescents)

Outpatient Treatment: Mental Health (Adults)

Outpatient Treatment: Mental Health (Children and Adolescents)

The CARF accreditation recognizes Helping People Succeed’s commitment to improving the quality of the lives of the individuals served. The accreditation goes through November 30, 2026.

In addition to serving children, Helping People Succeed began to serve adults during the midst of the pandemic when other community resources were overburdened and unable to accept any new clients. The programs fall under the umbrella of the Behavioral Services Department.

Other mental health services provided by Helping People Succeed include psychosocial rehabilitation services, therapeutic summer camps, after-school programs and a social skills group for children and young adults on the autism spectrum.

Helping People Succeed is celebrating 60 years of service to the community. Through its diversified, effective program services and initiatives, hundreds of thousands of the most vulnerable local children, families and adults have been able to transform their lives through education, counseling, training, and employment. For more information, contact Glenna Parris at 772-320-0778.

Helping People’s Succeed’s Targeted Case Managers meet on a weekly basis to ensure clients have the support they need to meet their goals.

Hibiscus Children’s Center

Announces 2024-25 Board of Directors

In Photo: Michael LaPorta

Treasure Coast – Hibiscus Children’s Center (HCC), a non-profit that provides life-saving services to children and youth from across the State of Florida, announces the appointment of new board officers to its Board of Directors.

Beginning July 1, the new officers are: Michael LaPorta – Chairman, Nicholas Ferraro – Vice Chair, Tracey Dexter - Treasurer, Mike Harrell - Secretary, and Scott Roads - Past Chair.

For over 39 years, Hibiscus has never wavered from its mission to provide safe haven, mental health, preventative care and life skills for at-risk children and families.

Hibiscus serves over 150 children annually in our residential programs and 1,800 children and families through our community outreach programs.

Incoming Board Chairman Michael LaPorta has supported Hibiscus since 2007 and currently serves as Vice Chair of the Hibiscus Board of Directors. He joined the Indian River Foundation Board in 2015 and became a member of the Board of Directors in 2017. He has also served on the Development and Performance Quality Improvement (PQI) Committees and as Chair of the Directorship Committee.

Michael LaPorta said, “I believe HCC is often the last best hope for children who have been dealt a terrible hand. At an early age, they have faced trauma, abuse and abandonment and deserve the community’s help to get their lives back on track. HCC plays a vital role in helping these children.”

Hibiscus recognizes returning members: Dan Braden, John Corbett, Beckett Horner, Esq., Deborah Kessler, Frank Noonan, Fernando Petry, DO, Joseph Trapani, Travis Walker, Esq., and Dave Wilson. The Board of Directors is comprised of individuals from the medical, business, and volunteer communities. The Board oversees the operations, overall management, and fiscal responsibilities of Hibiscus Children’s Center.

Under the guidance and leadership of its new board officers and directors, Hibiscus Children’s Center looks forward to continuing to fulfill its mission of saving children’s lives and making a meaningful difference in the lives of children and families in our community.

Grape Living Celebrates New Opening & Ribbon Cutting with Hobe Sound Chamber of Commerce Business After Hours

In Photo: Jen & Luis Reyneri - Grape Living

Article & Photos by: Robin Hall - Out2News.com

Hobe Sound – On Thursday, March 27, 2024 The Hobe Sound Chamber of Commerce had a Business After Hours at Grape Living in Stuart. Owners Jen & Luis Reyneri welcomed everyone with open arms and a delicious arrange of food and a wonderful collection of wine from many wine distributors. The event started at 5:30 pm and went until 7:00 pm at the newly open business located at 7190 SE Federal Highway in Stuart. If you love wine and beautiful Consignment art you will love this beautiful warm place to browse. They are dedicated to both interior design enthusiasts and wine connoisseurs. They are open Monday through Friday, from 10 AM to 5 PM. Jen & Luis Reyneri are the owners of The Grove Cucina & Wine Bar located in Hobe Sound.

The Hobe Sound Chamber of Commerce plays a significant role in the Martin County and northern Palm Beach County business community. The Chamber is a business organization financed entirely by membership investments. It provides opportunities for members to stay connected, network, advertise, receive continuing education, business support and always gives back to their community. They are located at: 8958 SE Bridge Rd, Hobe Sound. Contact them at: 772-546-4724

Out2News.com is your local Treasure Coast online newspaper where you are the reporter, photographer and YOU report the news! Do you have something to say, an event to a talk about? An event you would like us to have covered.

Photo by: Courtesy of Robin Hall - Out2News.com

Out2News.com adheres to full compliance with C.O.P.P.A. (Children's Online Privacy Protection Act of 1998)

"Your Treasure Coast Newspaper & Photo Journal"

Copyright © 2024 Out2News.com LLC. All Rights Reserved.

Jensen Beach Chamber Directory

CLICK ABOVE FOR REPORT

Sandhill Cove Residents Support Family Promise of MC

In Photo: (Front) Jean Matheson, Fran Andre, Karen Edds, Audrey Cox, Bobbie Spillman, Jane Coutts, Jane Fitzgerald, Marie Terry, Phyllis Kordick, Ellyn Capper, Jean Eldridge, Barbara Bretas, Andrea Lutz, (middle row) Shawn Perrigo, Genie Buchanan, Eileen Vergoz, Fran Atwood, Barbara Grimmer, Jenny James, Jane Shoaf, Jane Reynolds, Elaine Treweek, Shirley Kelley, Jane Funston, Kathy Garlington, Pat Morgan, Chuck Morgan, Isa Von Hessert, Laurie Bohlke, Sandy Chapin, (back) Paul Freud and Madeleine Bozone, executive director of Family Promise

Article by: Jackie Holfelder / Photo by: Sandhill Cove

Sandhill Cove Retirement Living in Palm City – and those who live there - have a long tradition of supporting individuals and nonprofits in Martin County.

A resident who has been involved with Family Promise of Martin County hosted a series of educational lunches of groups of six which spanned a two-year period during which other residents learned about an exciting program in which Family Promise is partnering with Project LIFT.

Family Promise is a nonprofit, interfaith hospitality network that provides temporary assistance, shelter, transitional housing, and case management for families in Martin County experiencing homelessness. It provides counseling in a variety of different areas to ensure that families are ready to own their own or rent homes when they have completed the nonprofit’s Almost Home Program.

However, due to the shortage of affordable housing plaguing the Treasure Coast, there was no place for the families to go when they were ready to move towards successful independence.

Family Promise embarked on a partnership with another Treasure Coast nonprofit, Project LIFT, to build tiny homes which are then placed on real estate that Family Promise provides.

Project LIFT is an award-winning nonprofit that teaches skilled trades to youth in a non-traditional school setting.

Madeleine Bozone, executive director of Family Promise and Bob Zaccheo, CEO of Project LIFT, attended the Sandhill Cove resident luncheons to explain their partnership and the logistics of the program

The cost of each tiny home is $63,000 for the home, $9,000 to transport it to the designated location, up to $20,000 for infrastructure including water, sewer and electric, and $8,000 for furnishings, including appliances.

After each luncheon, every invitee wrote a check and Sandhill Cove Retirement Living residents are now in the process of underwriting their second tiny home! They anticipate continuing with this mission in the future and look forward to learning about the families who will be living there.

Sandhill Cove leadership supports many nonprofits in Martin County and works cohesively with residents on mutual charitable projects.

MAK's Minute: Bathtub Beach Dredging

Project Lift Electrical Apprenticeship Program

MAK'S Minute: What is a Consent Agenda Item?

Focus Not Blame: Solving Florida’s Water Woes

Florida’s complex water issues are at the center of heated debate this summer. But let's face it, this isn't new; every summer, we witness this green menace resurfacing in our waterways. The blame game will not fix anything; it's high time we shift our focus toward real solutions.

For years, Lake Okeechobee releases were blamed for the blooms that scientists say can have public health impacts and negative effects on marine life and seagrass growth. Even though there haven’t been any major discharges from the lake this summer, the algae are spreading into the canals, which lead to estuaries on Florida’s East and West Coasts.

We all know hurricanes play a role in exacerbating the problem, stirring up sediments and flooding waterways with sewage and stormwater runoff. The heat of the summer brings massive blooms. It is basic science: sun, warmth, and nutrients create a perfect breeding ground.

What we are also seeing is a glimpse of what the new Lake Okeechobee System Operating Manual (LOSOM) operation system is going to look like. We know under LOSOM that the lake will be too high, too often. When the lake is too high the result is an algae-filled lake. That’s exactly what’s happening.

Environmentalists point fingers at the usual suspects—the Army Corps of Engineers, South Florida Water Management District, and Lake Okeechobee. They claim that LOSOM could have prevented this. But Floridians need to know the state’s water system is complex.

It involves a combination of natural and engineered components, as well as the coordination of various stakeholders and agencies. The infrastructure includes canals, levees, and water control structures, which are designed to regulate water levels in the lake and prevent flooding in our communities.

Every drop of water that falls on Florida is managed through careful planning, monitoring, and decision-making by multiple entities making it a challenging and complex task. It’s a balancing act.

So, it is dishonest that some environmental groups are complaining that not enough water was sent south during the dry season, and it's disingenuous for those same groups to complain about water releases when lake management capabilities were evident from the start. The governing board deserves credit for doing what it could under the limitations of the programs in place.

There is no one perfect solution. But we don’t need hypocrisy and lies to muddy the waters. Let’s work together to keep improving on this fluid situation.

-Nyla Pipes/Executive Director of One Florida Foundation, a non-profit that provides education and proposes solutions regarding Florida’s water resources

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Out2News. Any content provided by our bloggers or authors are of their opinion, and are not intended to malign any religion, ethic group, club, organization, company, individual or anyone or anything.

What To Do When Your Employee Sues You

Dealing with an employee lawsuit can be challenging and stressful situation for any employer. It’s essential to handle such situations carefully and in compliance with the law. Here are some key steps to sonsider if you find yourself facing an employee lawsuit.

Consult with an employment attorney: As soon as you become aware that an employee is suing you or your company, seeking legal advice from an experienced employment attorney is crucial. An attorney specializing in employment law can provide valuable guidance, assess the merits of the claim, and help you navigate the legal process.

Review and preserve relevant documents: Collect and review all relevant documents related to the employee’s employment history, including contracts, performance evaluations, disciplinary records, and any other relevant communications. Preserve these documents to ensure they are readily available for your attorney and any legal proceedings.

Notify your insurance carrier: If you have employment practices liability insurance (EPLI), it’s essential to notify your insurance carrier promptly. EPLI can provide coverage for legal expenses and potential damages associated with employee claims. Informing your insurance carrier ensures that you comply with any requirements and allows them to guide you through the claims process.

Maintain open communication with your employee: It is generally advisable to maintain open lines of communication with the employee who filed the lawsuit. However, consult with your attorney to determine the appropriate level and manner of communication to avoid any potential legal pitfalls. Avoid making any statements that could be interpreted as an admission of guilt or liability.

Conduct an internal investigation: In some cases, conducting an internal investigation may be necessary to gather facts and assess the validity of the employee’s claims. This investigation should be handled carefully and impartially. Consider involving a neutral third party, such as an HR consultant or investigator, to ensure objectivity and fairness.

Develop a legal strategy: Work closely with your employment attorney to develop a sound legal strategy based on the specific circumstances of the case. Your attorney will guide you through the legal process, advise you on potential defenses, and help you determine the most appropriate course of action, such as settlement negotiations or litigation.

Document all interactions and decisions: Throughout the lawsuit process, it’s crucial to keep detailed records of all interactions, decisions, and steps taken. This documentation can serve as evidence and support your position if the case progresses to court. It can also help demonstrate that you have followed proper procedures and acted in good faith.

Consider settlement options: Settlement negotiations can be a viable option to resolve the lawsuit without going through protracted litigation. Your attorney can help assess the strengths and weaknesses of your case and negotiate a fair settlement that protects your interests. Weigh the potential costs, time, and reputational impact of a trial against the benefits of reaching a settlement.

Prepare for litigation, if necessary: If settlement negotiations are unsuccessful, be prepared for the possibility of litigation. Your attorney will guide you through the litigation process, including gathering evidence, preparing witnesses, and presenting your case in court. Be diligent in complying with all court deadlines and requirements.

Focus on preventive measures: While dealing with an employee lawsuit, it’s crucial to evaluate your internal policies, procedures, and employee management practices. Identify any areas of weakness or potential liability and take proactive steps to prevent future claims. Regularly review and update your employee handbook, provide training on employment laws, and maintain open lines of communication with your employees.

Remember, each employee lawsuit is unique, and the steps outlined here are general guidelines. Consulting with an experienced employment attorney who can provide tailored advice based on your specific circumstances is essential. By taking prompt and appropriate action, you can navigate the legal process more effectively and protect your rights and interests as an employer.

As always, if you have any questions about buying or selling a business, or business law generally, please don’t hesitate to contact us!

Click photo above for St. Lucie County Chamber of Commerce Business Directory